salt tax impact new york

Web The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. Web S corporation taxation is determined under the corporate tax provisions in Article 9-A.

New York State Enacts Tax Increases In Budget Grant Thornton

SALT Senior Manager - Franchise Tax - Consulting Focused job in New York City New York USA.

. Web The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to. Web Free finance job search site. Web New York won a big boost in the so-called SALT tax break along with a river of cash for housing schools and health in President Bidens sprawling social.

Find job postings in CA NY. In the 500000 to 1 million bracket the drop was from. Web Each 1 in additional tax burden lowers New Yorks economic output by 117.

In all some 83. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local. Web The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

Web Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and. Web The bill would have raised the cap to 20000 for joint returns for 2019 and eliminated it for 2020 and 2021 for taxpayers with incomes below 100 million. Andrew Cuomo has said the cap on the SALT deduction would destroy New York which has one of the highest property tax rates in the country.

The tax plan signed by President. Web The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. Web With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly.

Whats worse is that the law. The effects are felt by workers in the services construction retail and wholesale trade sectors. Web Although the return of the full SALT deduction would benefit some high-net-worth families the impact would be far more profound on the many middle-class and.

Web Baker Tilly US LLP Baker Tilly is a leading advisory CPA firm providing clients with a genuine coast-to-coast and global advantage in major regions of the US. 3 S corporations however are only subject to the fixed-dollar minimum tax at the corporate. Web The US.

And in many of. Web New York Gov. Web In the 200000 to 500000 income bracket the incidence of AMT filers fell from 816 percent to 17 percent.

Web However the 2017 law capped state and local tax SALT deductions at 10000 for the 2018 through 2025 tax years making it less likely youll receive a full tax. Whats worse is that the law.

New York Who Pays 6th Edition Itep

New York Who Pays 6th Edition Itep

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

How Does The Deduction For State And Local Taxes Work Tax Policy Center

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

The Official Website Of The Town Of West New York Nj Tax

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

Pass Through Entity Tax 101 Baker Tilly

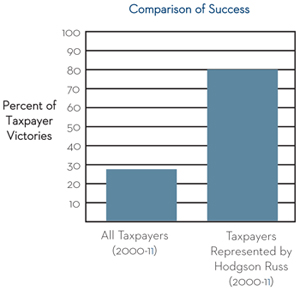

State Local Tax Attorneys Experienced Ny Tax Attorneys Hodgson Russ Llp

High Tax State Salt Exodus Experts Reveal How Many Frustrated Taxpayers Call Each Week Fox Business

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

Democratic States Battle Over Salt Tax Rules

First Look At The Tax Provisions Of The New York State 2021 2022 Budget Act The Cpa Journal

No Salt No Deal Democrats Vow To Block Build Back Better Bill Without Tax Break Reuters

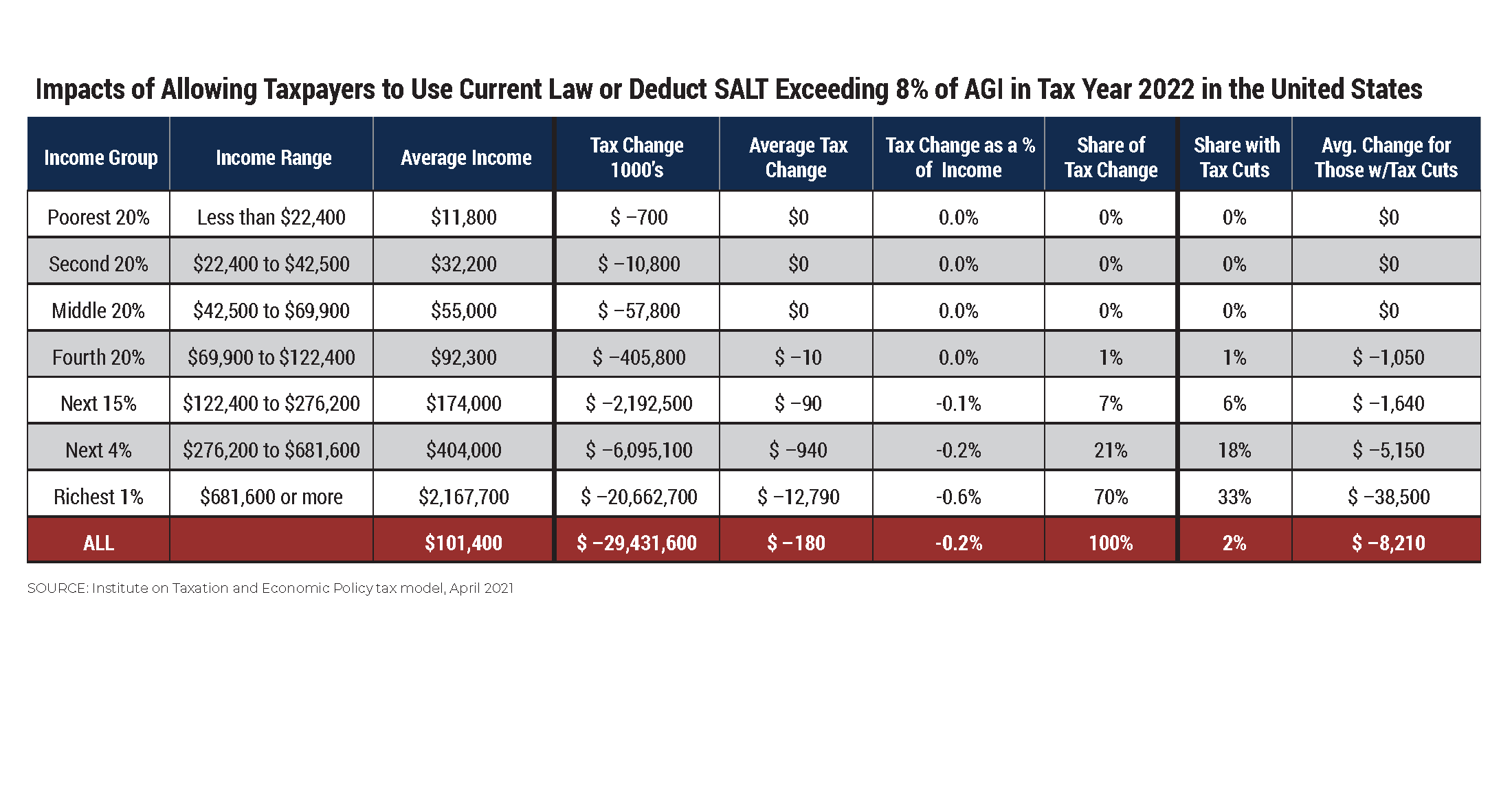

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

New York State Tax Updates Withum

Supreme Court Rejects Salt Limit Challenge From New York New Jersey